Revolutionary Sand Battery Holds Huge Potential

Finnish companies Polar Night Energy and Vatajankoski have built the first commercially operating sand battery which is essentially an insulated silo that is filled with sand.

The sand is used as an energy storing medium, where renewable electricity is converted to heat and then stored. The sand battery has the capacity to store heat at high temperatures for months. This method of storing renewable energy for heating could be a great solution in contrast to some the limitations and expenses of using lithium battery.

The great thing about the construction of the sand battery is that it that the materials can be sourced from anywhere and the quality of sand can be low-grade meaning it doesn’t need to conflict with the building and construction industry where there is a huge demand for high quality sand.

Energy storage is a key issue in the transition to green power, this reliable and effective way of storing excess renewable energy as heat to be used when it is needed most is a fascinating step forwards in this rapidly evolving energy landscape.

(Source: https://polarnightenergy.fi/technology)

BP takes largest stake in $52b Australian green hydrogen hub

Oil and gas giant BP has become the largest shareholder in the Asian Renewable Energy Hub (AREH).

The company will take a 40.5% stake and become the operator of potentially the largest renewable energy and green hydrogen hubs in the world.

The project is taking place in the Pilbara region, Western Australia on a 6,500 square kilometre site.

The AREH plans to develop wind and solar power generation that will be equivalent to a third of the electricity generated in Australia. At full capacity the it project is expected to be able to produce 1.6 million tonnes of green hydrogen or 9 million tonnes of green ammonia per annum.

AREH is expected to abate around 17 million tonnes of carbon in domestic and export markets annually.

(Source: https://www.bp.com/en/global/corporate/news-and-insights/press-releases/bp-to-lead-and-operate-one-of-the-worlds-largest-renewables-and-green-hydrogen-energy-hubs-based-in-western-australia.html)

A Net-Zero Future - Electrifying Industry & Transport

As sectors like transport transition to becoming more electrified, increased energy supply challenges will start to emerge. Managing this electricity demand is crucial for the long term transition to net-zero emissions. For heavy industry, reduced energy use – as part of a broader shift away from fossil fuels – will reduce business costs and increase competitiveness.

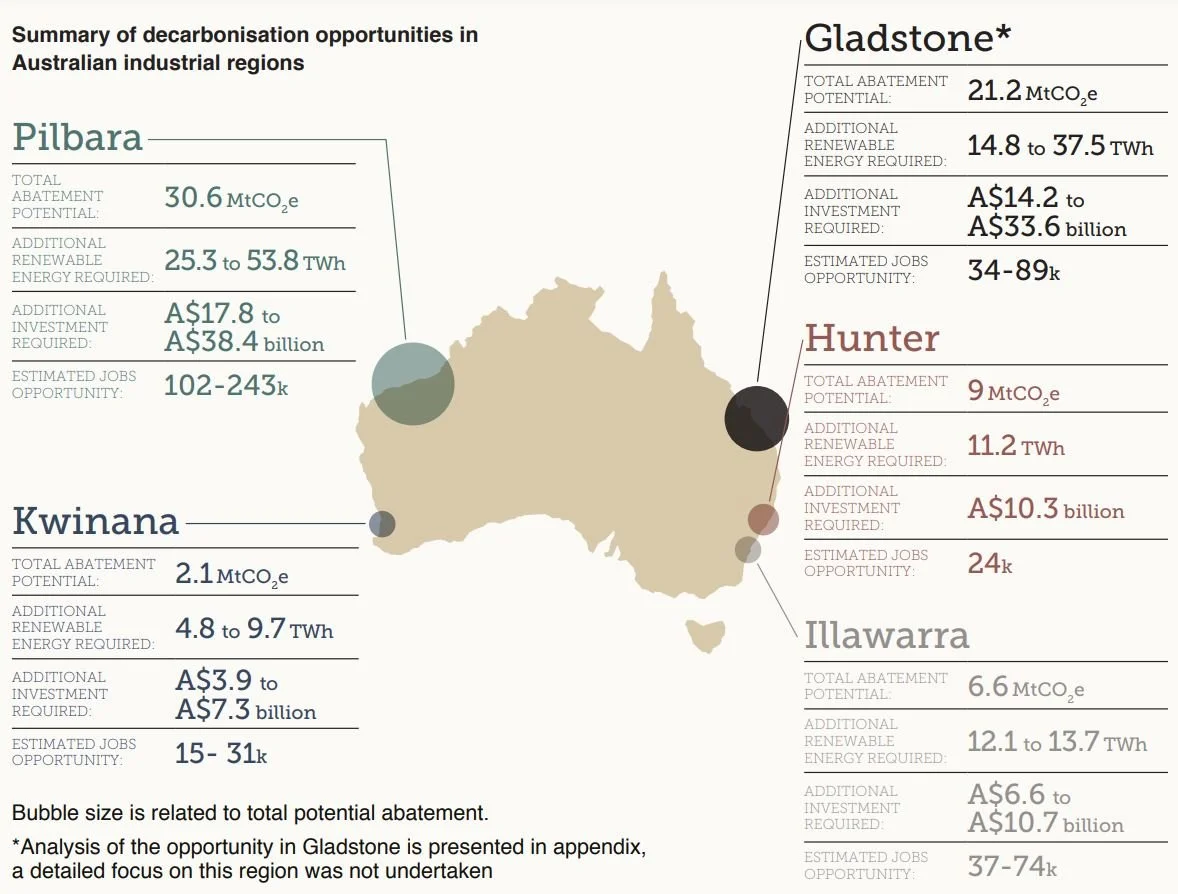

The Conversation recently contributed to a report by the Australian Industry Energy Transition Initative called ‘Setting up industrial regions for net zero’ - a guide to decarbonisation opportunities in regional Australia.

Some key points from this report below -

Industry is taking real steps forward on the development and deployment of emissions reduction technologies and investing in projects to decarbonise operations in the regions they operate in.

Investment is accelerating momentum. It is no longer an option to wait and see what happens next – action is urgently needed now or we risk falling behind other nations.

The role of industry cannot be underestimated. Industry’s early uptake and effective integration of renewable electricity, electrification and clean hydrogen will shape our future energy systems and enable access to future markets.

No doubt that the changes needed will be tough and there will be significant short-term challenges to navigate of existing operations and associated infrastructure.

‘The report highlights a coordinated transition could lead to wider benefits such as thousands of new jobs and cuts to greenhouse gas emissions.’

As we observe this transition in sectors like industry and transport, the Australian Energy Market Operator will be faced with the challenge of integrating renewable energy generation and storage, and a greater use demand management in the next Integrated System Plan for the National Electricity Market.

To read the full report by The Australian Industry Energy Transitions Initiative click on the link below.

A Future of Rising Power Prices

(Photo: Marcus Wong)

Despite Australia having its own homegrown energy resources the price of power for households and individuals will continue to increase.

There are a number of factors effecting this current energy crisis, one prominent influence is the Russian-Ukraine war which is having an impact on energy supplies and the global supply chain with most European countries rejecting Russian oil and gas but without a plan an alternative to replace this supply. But also the recent catastrophic weather events in south east Queensland and New South Wales have also adversely effected power prices by creating extreme spikes in demand.

Despite these recent global and national crises, the price of fossil fuels has been steadily going up, and because Australia relies on imported energy because it exports most of its fossil fuels, we aren’t exempt from the broader fluctuations of the global energy market.

Unfortunately, it seems like this instability will continue, households and businesses can reduce bills by choosing to generate their own renewable, for example through solar power.

As the larger transition away from coal fire power stations continues we can expect the ongoing increase in power costs.

(Credit: https://newsroom.unsw.edu.au/news/business-law/energy-crisis-why-are-electricity-prices-set-rise)

VIC Government Supporting Businesses to Become Sustainable

Now is a great time to make the switch to solar for Victorian business owners as there is great financial support and rebates from Solar Victoria.

Victorian businesses are currently eligible for:

$3500 rebate from the Victorian Government

$5000 Interest free loan from the Victoria Government

Federal Government STC Discount - Upto $12,500 Discount

A solar PV system will reduce your power costs by more than 50% (up to $7,500 annually) and create long-term security against rising energy prices.

For more information about the Solar for Business Program visit Solar Victoria through the following link:

https://www.solar.vic.gov.au/solar-business-program

Global Energy Review 2020

In response to the exceptional circumstances stemming from the coronavirus pandemic, the annual IEA Global Energy Review has expanded its coverage to include real-time analysis of developments to date in 2020 and possible directions for the rest of the year.

In addition to reviewing 2019 energy and CO2 emissions data by fuel and country, for this section of the Global Energy Review the IEA has tracked energy use by country and fuel over the past 3 months and in some cases – such as electricity – in real time. Some tracking will continue on a weekly basis.

The uncertainty surrounding public health, the economy and hence energy over the rest of 2020 is unprecedented. This analysis therefore not only charts a possible path for energy use and CO2 emissions in 2020 but also highlights the many factors that could lead to differing outcomes. The IEA draws key lessons on how to navigate this once-in-a-century crisis.

Access the full report here.

Off-Grid Homes Are The Future

Video: Presented by Ecostore

Going off-grid has now become more viable than ever with the improving sophistication, affordability and efficiency of renewable energy technologies. There are innumerable benefits to being self-powered through the use of solar panel systems in conjunction with battery storage such as those offered by Tesla.

The independence afforded by these technologies creates protection from power outages and high electricity prices plus the ability to run appliances freely without feeling guilty. An off-grid home generates and uses continuous power solely from the Sun.

Metta Energy solar expert Michael Brooks has offered some valuable insights into off-grid solar homes in a feature by Realestate.com which can be viewed in the video above.

Click the link below to go through and read the full article on their website.

https://www.realestate.com.au/lifestyle/why-off-grid-solar-homes-are-the-way-the-future/

Resilient Energy Collective Provides Off-Grid Power to Bushfire Effected Areas

Photo: https://www.resilientenergy.com.au

Australian billionaire Mike Cannon-Brookes has co-founded the Resilient Energy Collective, an initiative designed to bring solar power and battery storage solutions to communities that have had energy supplies disabled through the effects of bushfires and storms.

Following the recent bushfire crisis in Australia which has destroyed lives, wildlife, communities and important infrastructure there are many areas that are still without normal services such as electricity. The Resilient Energy Collective has teamed in with 5B, an innovator designing portable and prefabricated solar arrays and Telsa, with their reliable battery storage, to provide stand-alone power systems to communities and essential services.

It is a shift away from the need to rely on the pole and wire approach for power and electricity that can provide more stability to remote locations and communities which are vulnerable to the changing effects of the climate. The systems themselves can be deployed within a day and will ensure clean and reliable energy that not only establishes and reconnects services for communities but will also contribute greatly to a more sustainable future.

“In the future, we see a world in which many remote communities operate on solar power, off-the-grid. It will be more stable, more resilient and less prone to damage,” Cannon-Brookes says.

“This is a perfect solution to a massive problem. It will restore power faster. It’s renewable, reliable and clean.”

Solar powered “Melbourne Quarter” precinct wins CEFC backing

By Sophie Voratth

Source: onestepoffthegrid.com.au

A major new solar powered commercial precinct in the heart of Melbourne’s CBD has won the backing of the Clean Energy Finance Corporation, as part of a portfolio of sustainable development projects with property group Lendlease.

The CEFC said last week it would commit up to $100 million in equity to Australian Prime Property Fund Commercial (APPF Commercial) – a leading sustainable commercial property fund managed by Lendlease.

The CEFC said the investment would help ensure developments within the portfolio followed best practice energy efficiency programs – among them, the landmark hybrid commercial and residential development, the Melbourne Quarter (above).

The $4.5 billion project will incorporate what Lendlease claims will be one of Melbourne’s largest solar PV installations (One Step has asked for specifics on this), as well as energy efficient design, a captured storm-water irrigation system, and a car share program.

Lendlease says it is also investigating the feasibility of including electric vehicle charging stations in the build.

The commercial part of the development – it is expected to accommodate around 13,000 workers, once finished – will be built to a 6 Star Green rating, while the residential part, which will house 3,000, will aim for a 5 Green Star rating, the company says.

The investment by the CEFC is one of a string of property-focused plays by the green bank to be rolled out over the past year – although so far, mostly focused on residential development.

Just last month, it committed $90 million in debt finance to the plans of housing developer, Mirvac, which is building more than 300 family homes, each with built-in solar and battery storage.

And in August last year, the CEFC committed $32 million in finance to a 428-bed student accommodation project in Adelaide, as part of an effort to set a new benchmark in energy efficiency building.

CEFC CEO Ian Learmonth said the CEFC investment in APPF Commercial would help set a new benchmark for the investment fund, which was now aiming for a net zero carbon property portfolio target by 2025 – well ahead of the industry standard.

The investment also expects to deliver the abatement of more than 40,000 tonnes of carbon emissions over the expected lifetime of the assets in the portfolio.

“Buildings account for nearly a quarter of Australia’s carbon emissions,” said CEFC CEO Ian Learmonth in a statement on Thursday.

“Lendlease and other industry leaders recognise the need to move towards net zero carbon buildings and we’re working together to identify ways in which that can be achieved as early as possible,” he said.

“A key focus of this investment is its ability to demonstrate, through the Melbourne Quarter development, how sustainability and design initiatives integrated across an entire precinct can

transform the way we work and live, with zero carbon outcomes.

“This approach delivers emissions savings over and above what could be achieved in a standalone building, by networking and sharing technologies across the buildings and facilities within the

development precinct,” Learmonth said.

“This investment with Lendlease is another strong example of how clean energy can be used across the built environment to deliver long term economic and environmental benefits,” said CEFC property lead Chris Wade.

It provides a model for other precinct-scale developments Australia-wide.

Josh McHutchison, managing director at Lendlease Investment Management said the CEFC’s investment in APPFC formed part of the fund’s most recent equity raise.

“We look forward to working with the team at CEFC to implement innovative solutions to achieve our sustainability aspirations and deliver superior outcomes for our tenant community,” he said.

The first stage of the Melbourne Quarter precinct is on track to be completed in 2018.